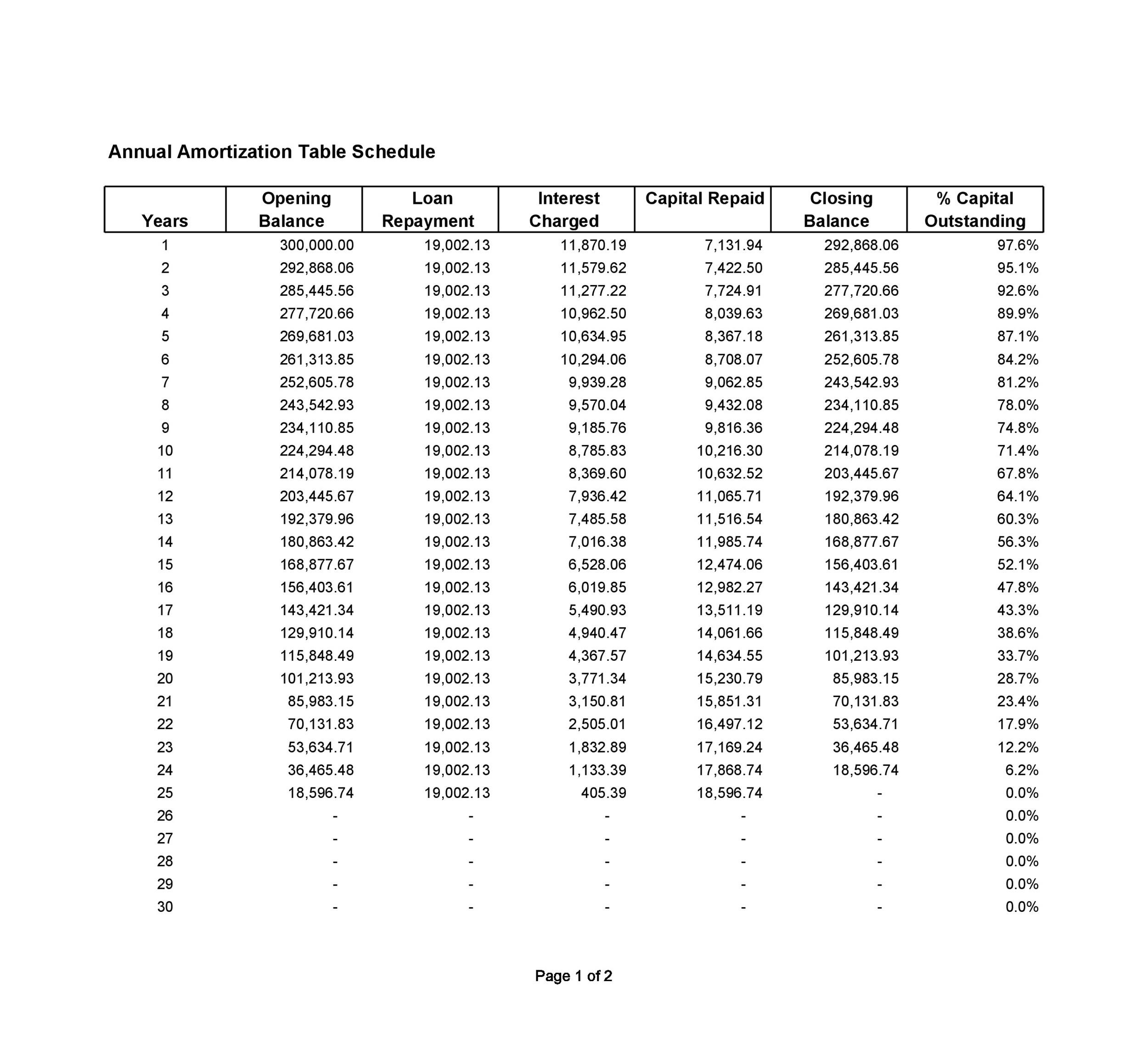

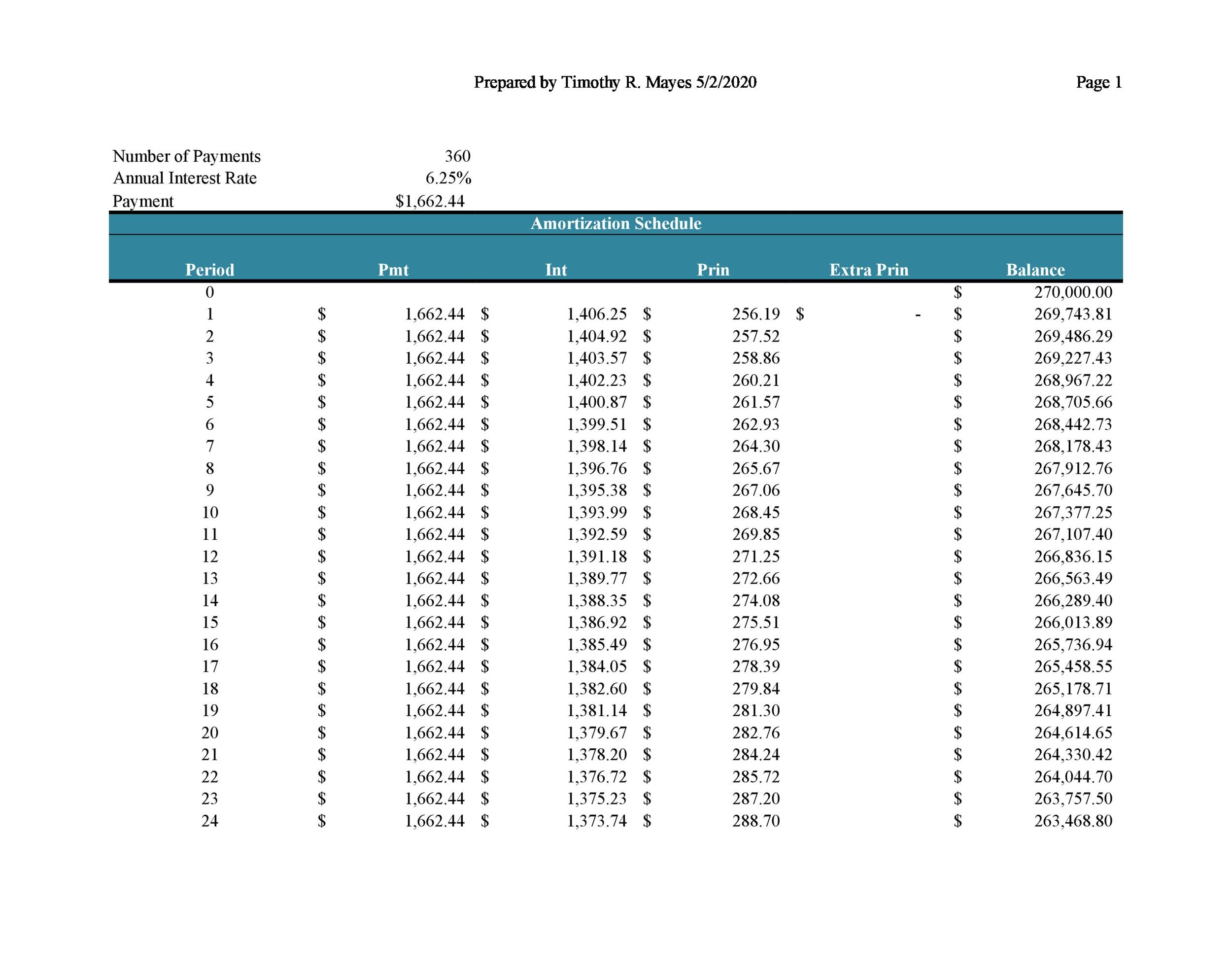

But, these long loan terms are often reserved for borrowers with high credit scores. Many lenders offer land loans for 10 – 30 years. However, not all land loans are so short. These short loan terms involve a large upfront payment along with high monthly payments. Many land loans have short loan terms, ranging from 2 – 5 years. What are typical land loan terms?īecause lenders consider land loans risky, they work differently than home loans or construction loans. All you need to do is input the size of the loan, the loan terms, and the interest rate associated with your land loan. The land loan calculator above will tell you your monthly payments and the expected interest amount.

Land loan amortization calculator full#

When you apply for a loan, lenders will look at your debt-to-income ratio, liquidity, and full financial history. Lenders will look at your entire financial history, not just your credit score. For raw land loans and unimproved land loans, lenders may require a higher credit score. In general, lenders want borrowers who have a credit score of 720 or higher. Like other loans, you will need to have a good credit score to apply for any type of land loan. Improved land loans are the least risky and are similar to mortgage loans.įurthermore, the land loan calculator can apply to many subclassifications of loan with specialized lenders:Įach land loan has slightly different requirements. Improved land loan: Unlike the other two options, improved land has many standard amenities like water, power, and gas. Unimproved land loans are easier to get than raw land loans. Unimproved land loan: Unimproved land loans apply for land that has some utilities but lacks an electric meter, phone box, or natural gas hookup. Raw land loans are considered the riskiest. If you apply for a raw land loan, you will need to present a detailed land development plan. In general, undeveloped land has no electricity, sewers, roads, or other improvements. Raw land loan: These land loans apply to undeveloped land. There are three types of land loans you should be aware of. Conversely, land loans are only used for financing the purchase of the land itself. Construction loans are used to finance the building costs of a home or building.

Land loans are sometimes confused with construction loans. The type of land loan you apply for will depend on where the land is and how you plan on using the land. Land loans can be used to buy land for residential homes for business purposes.

0 kommentar(er)

0 kommentar(er)