- Quickbooks small business track mileage how to#

- Quickbooks small business track mileage update#

- Quickbooks small business track mileage download#

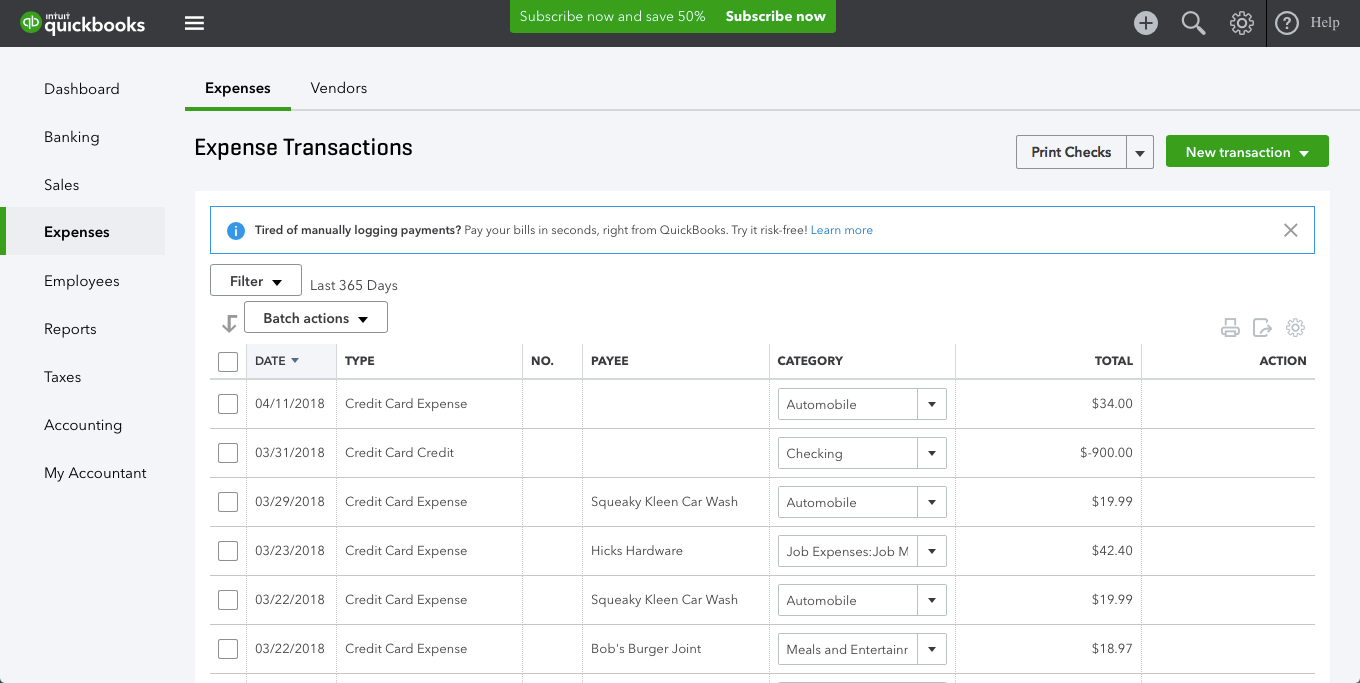

Want to see a tutorial of this? There’s a video tutorial on this subject in my course, along with 35+ lessons on how to manage your own bookkeeping, be 100% prepared for tax season, and overall increase profits. That’s it! Each time you enter a business trip, it tells you how much money you get to deduct! I would definitely recommend doing this each month to stay on top of it, that way it doesn’t add up and give you headaches come tax time. I have personally tried this and it’s honestly so much work to have to swipe right or left (answering if it was business or personal) for every single trip… But if you’ve got a ton of business trips, again, you might like this feature. If you travel A LOT, you can have the Quickbooks app on your phone track your trips. My only advice here is to take good notes on the location, because you’ll be able to look up the distance for mileage expenses when needed.Ĭlick on the mileage tab and add a new trip.

Quickbooks small business track mileage download#

It also helps to download the app onto your phone because you can enter mileage that way as well!ĭo you have a calendar? If so, this will come in handy! At the end of the month, you’ll be able to look back at all the business meetings you had. Make sure you have a Quickbooks Online account (the Simple Start version starts at $12.50/month). In QuickBooks Time, go to Time Entries, then select Timesheets. STEP 1 - Activate your Quickbooks Online account

Quickbooks small business track mileage update#

If you don’t see Track Mileage in the Preferences, update to the latest release of QuickBooks 2023. Under Track Mileage, select Advanced version. Regardless of the route you choose, it’s important to keep up with the actual mileage for your business to ensure accurate reporting: Learn how to get your mileage logs and reports. Here’s how: Go to Edit and then select Preferences Go to Time & Expenses and select Company Preferences. However, if you are constantly traveling to new locations for business that aren’t your typical workplace, your CPA may recommend that you put select auto expenses on your business account. I simply track my mileage in Quickbooks, and then it’s pretty nice when I get a portion deducted from my income at year-end!

Because of this, I do not use my business account to pay for my auto expenses. This is a great question to ask your CPA because they will help determine if your business has a large amount of mileage expenses, and if it’s worth using your business accounts for this.įor example, I am a smaller business and work from home, and have a small amount of mileage expenses. If you use your business accounts to pay for all auto expenses (business and personal), not all of it will be deductible. Should I use my business account for auto expenses? Tracking your mileage can become cumbersome and most of the time its easy. What does NOT qualify as a business trip?ĭriving from a business meeting to home (or somewhere personal) Like many small business owners, being on the go is a part of the business model. Tracking mileage will save you money, time, and headaches come tax season, so why not take advantage of this feature in Quickbooks Online now?!įirst off, let’s learn a little bit about tracking mileage:ĭriving from your workplace to a business meeting/errandĭriving from that business meeting/errand back to your workplace So, it might pull in deposits automatically for you to mark as business or personal transactions.Do you travel for work or have business meetings outside of your workplace? Do you need help when it comes to tracking your mileage in Quickbooks? Does the thought of tracking it overwhelm you? This feature may work just fine if you connect a bank account. You can only clear this up when filing taxes through Turbo Tax and entering W2s, other tax documents, and manually enter income. Therefore, the running "Profit/Loss" number at the top of the screen is pretty inaccurate. Checks or other forms of payment (outside of QuickBooks) will not show up as income. CONSĪs far as I've been able to tell it has no way of tracking or entering Income unless a customer pays through the QuickBooks portal. Its integration with TurboTax makes it very easy to file taxes as it pulls in all the business expenses and categorizes them for you. The mobile app can also track your mileage put on a vehicle for business purposes all year long.

It takes less than a minute to enter an expense and upload a receipt. It is very easy to track business expenses. This product was built for the person running a sole propriety. Thinking about moving up to QuickBooks Online if our profits go up and can justify the price tag. Lightspeed Retail offers a complete POS system for managing sales channels, inventory, and analytics in one platform. Still keeping our eyes open for other options. While it has its flaws, it is still better than the alternative.having no tools to help record business expenses. QuickBooks Self-Employed has been the most cost-effective tool for tracking expenses that we have found so far for the Sole-Proprietor's small business.

0 kommentar(er)

0 kommentar(er)